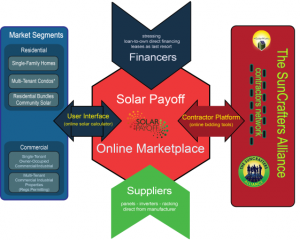

The Business Model. Solar Payoff is an online marketplace that promotes ownership of “rooftop” and other forms of distributed generation solar, including eventually community solar.

- Through its website at solarpayoff.com, Solar Payoff gives prospective solar consumers the tools to estimate and price their solar potential, comparing solar adoption according to four financing scenarios

- Solar Payoff serves as the hub and generates leads for a self-contained network of low-overhead, local and regional contractors, trademarked the SunCrafters Alliance

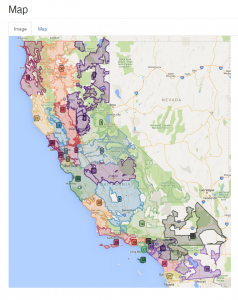

- Members of the SunCrafters Alliance are carefully screened and monitored and work on assigned, carefully designed Service Areas, in the beginning throughout California, soon in other States and eventually internationally

- Solar Payoff provides sensibly priced, one-off (i.e., no monthly per user subscriber-based) state-of-the-art bidding tools for SunCrafters Alliance members

- SAAS bidding software available at a freestanding second website, suncraftersalliance.com

- The solar ownership business model requires reasonable rate/term loans to succeed. Currently, the loan-to-own market is serviced by specialty lenders at rates and terms that sour the deal. As a result, Solar Payoff is actively soliciting mainline commercial banks with the intent of convincing one or more to treat loan-to-own solar like they treat auto loans.

- Lastly, at maturity, Solar Payoff would become a conduit for best-priced quality inputs, especially competitively-priced American panels.

The model takes the SAAS (“Software As A Service”) model to its logical conclusion by linking informed consumers to skilled contractors, then facilitating the transaction by providing access to solar loans for the cash-strapped “middle-class”. Why not another SAAS bidding tool for lease company or large contractor sales staff? Why “a system”? A short history explains.

Short History. In the beginning our vague objective was to provide smaller contractors access to solar leases. We had looked at building a contracting business ourselves and immediately discovered that the lease companies were refusing to work with smaller contractors, one-off. As a smaller contractor you couldn’t offer your clients a decent lease deal. You could find work at the bottom of the lease value chain as subcontractors, but you would be working for wages with little to no margin for overhead, none for profits. Contracting ourselves, starting from scratch, looked like an uphill climb. Years in the contractor trenches to pay for a Berkeley Ph.D contributed to my reluctance.

Taking a step back, I looked at the DG market for solar broadly. Cash was tight. Commercial banks wouldn’t touch solar for itself. And established, larger firms with access to the lease were running the table. “Cash flow positive from Day One,” the off-repeated pitch of the lease powerhouse’s call center operations, was working. The “something for nothing” lease proposition looked tantalizingly good to prospective solar adopters. At the same time, we could see that smaller solar contractors’ dependency presented an ironic opportunity. Organizing small contractors into a network, we would bring the lease barons to the table by delivering volume. That was the logic of the moment.

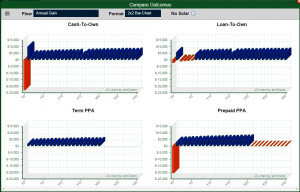

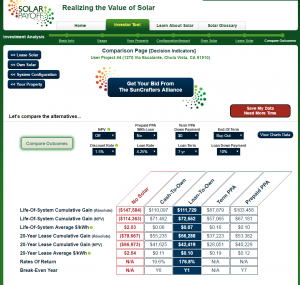

We also thought we could serve our contractor network by generating consumer leads. To do that, however, we needed a conduit, a web User Interface, to show consumers their potential gain. But to develop a User Interface we had to do the math. We did the math. The math clearly showed, not entirely to our surprise, that the lease value proposition didn’t hold up. This was especially so if we used realistic end-of-term assumptions (no, you won’t get the system for free at term) and ran those numbers against loan-to-own under “reasonable” loan rate/term assumptions (somewhere in the neighborhood of a car loan or a residential mortgage).

On the back of an envelope, we could see that a typical suburban 3-4 bedroom homeowner could be giving up as much as 50 percent of the potential gain by leasing, compared to ownership financed with cash or a fairly priced, shorter-term loan. Solar leases, then and now, are a bad deal for consumers and small contractors. The concept of an ownership delivery “system” that passed consumers to small contractors, with financing to seal the deal, took shape.

There was more from our perspective. “Cash flow positive from day one” is nothing other than an invitation to swap utilities as the lease market becomes more and more concentrated. With a lease the solar consumer who was buying electricity from a fossil fuel monopoly will be buying electricity, albeit solar and at marginally less ¢/kilowatt-hour, from another electricity company, this time a leaseholder with deep pockets. When we say “deep pockets,” we mean hedge funds and the national brand-name banks. The latter won’t enter the loan-to-own market yet but will finance leases for the significant returns that they receive as “tax equity partners.” For that matter, lease winners include Google and Apple and all things Elon Musk. This is environmentally progressive – the fuel will be solar – but financially and socially not so much. As the lease is structured today, environmental progress has become the province of the already more than comfortable. Not where we want to be.

With this awareness at the heart of our business plan, Solar Payoff re-oriented itself to promoting loan-to-own solar. The tagline of the Solar Payoff website always was “Realizing the Value of Solar.” We just didn’t know what it really meant until we did the math. The math points out the immense advantages to owning your own solar.

Our User Interface at www.solarpayoff.com, demonstrates unequivocally the lease-ownership trade-offs. Our ContractorPlatform/BidModule, available at www.suncraftersalliance.com, brings the “systems approach” full circle by offering an SAAS platform where contractors in our network can develop a bid and negotiate from there their deal. Both platforms were developed with personal resources for approximately $150K, not counting my own time, using our Python/Javascript programmer team in Barcelona, Spain. All our programmers are graduates of the best computer science program in Spain and one of the best in Europe, the Facultad Informatica de Barcelona.

The Products. The Solar Payoff User Interface is a public-facing, fully developed “public good,” not designed to earn money. Its purpose is to create informed consumers primed for an almost risk-free investment in solar by demonstrating a return that typically tops any other legal use of the client’s money.

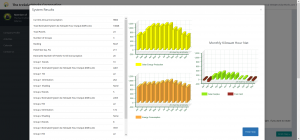

On the User Interface, solar prospects

- estimate solar generation in monthly and annual kilowatt hours using Google Maps GIS technology and the National Renewable Energy Labs PVWatts5 solar calculator

- price their system using industry standards in $/watt-DC

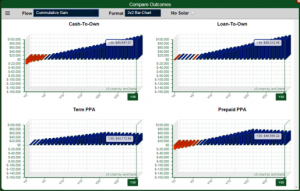

- project life-of-system (30-year) annual and cumulative investment net gains, both absolute and NPV, according to four financing scenarios and accounting for opportunity costs

-

- cash purchase

- loan-to-own

- term lease/PPA

- prepaid lease/PPA

- solicit bids from our contractors, each of whom receives leads from assigned GIS-defined SunCrafters Alliance Service Areas

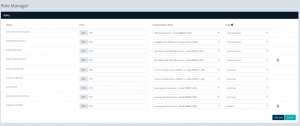

The second ready-to-go product is our industry-leading ContractorPlatform/BidModule (at www.suncraftersalliance.com) where SunCrafters Alliance contractors process Solar Payoff (and their own) leads. Contractors pay a modest user fee for processing a lead (no monthly fee) and a 3-5% commission only on jobs won. You-make-money-we-make-money is the Solar Payoff approach.

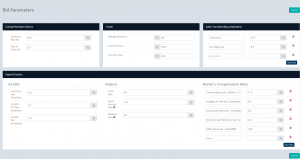

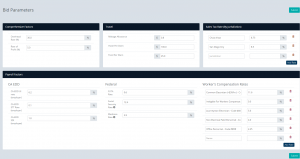

On our ContractorPlatform/BidModule, a contractor develops

- The Company Profile

- Basic Company Info: contact info, company officers, license and insurance info

- Key Bid Parameters: overhead rate, expected rate of profit, payroll factors (e.g., SSN and Medicare rates, state and federal UI, etc.), applicable workers comp rates, sales tax rates (by jurisdiction), travel comp

- Bidding Roles: generalized labor types where bid wages, workers comp classes, and relation to overhead are designated

- Personnel: actual employees assigned to roles and given accounting wages (for processing jobs in ContractorPlatform/JobsModule)

- Inventory: a priced list of contractors’ typically used equipment/materials with spec sheet links (panels, inverters, racking parts, and BOS)

- SunCrafters Alliance Service Areas: assignments to GIS-mapped service area(s) in a contractor’s region

- The Bid

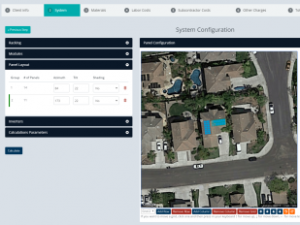

o Client Contact/Site Visit. review/correct User Interface usage/site info, design project conceptually

o MakeABid

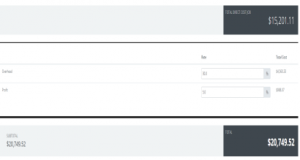

Job Pricing. specific material and labor assignments produce Total Direct Jobs Costs. Overhead computed as % of Total Direct Job Costs, Profits as % of Total Direct Job Costs Plus Overhead

Financials Recalculated. real input pricing is run back through our financial math to produce this-is-our-best-estimate financial projections for prospective solar consumer- investors to consider

Proposal PDF

The BidModule is operational today. An overview can be seen at www.suncraftersalliance.com. The “How It Works,” Slider at the bottom of The Landing Page provides an overview. A more detailed examination of the Contractor Platform/BidModule site can be seen in the final pages at www.solarpayoff.com/investors (u: investor; p: investor).

The Market For Distributed Generation Solar. According to Wikipedia, citing data from U.S. Dept. of Energy’s Energy Information Administration, all forms of solar, utility-scale and distributed generation, amount to only .94% of the approximately 4.08 trillion kilowatt hours of the electricity generated annually in the U.S. Approximately, two-thirds of solar today comes from utility-scale solar, solar produced by the established utilities themselves or bought from third-parties through Power Purchase Agreements (PPAs). It wouldn’t be surprising that that 2:1 split persisted or even grew in favor of utility-scale solar in the future, in terms of outright capacity.

However, an investor should consider a number of factors before writing off “rooftop” solar and other forms of distributed generation. First, only a small fraction of the properties that could take solar have adopted solar. There are a bit short of 13 million households in CA and only 600,000 or so have solar, less than 5%. And that’s California, by far the largest adopter of solar in the U.S. and, one suspects, the world. Last year alone, distributed generation (DG) solar added 3.5 gigawatt hours of electricity, almost one-third of the DG solar previously installed. In 2013, 400,000 or so homes in the U.S. had solar. In early 2016, that number nationally has grown to just short of a million. Only a beginning. 3.8 million homes are projected to have solar by 2020. There are roughly 70 million homes in the U.S. The market for our services in the U.S. is virtually unlimited, only constrained by our resources to capture it. This business will move to other countries where there is virtually no solar today. The untapped market is enormous.

Second, as we’ve already explained, simple math on the back of an envelope can show the typical residential and, although to a lesser extent owing to regulatory impediments, also commercial consumers of electricity that buying electricity from a utility who owns the grid is bad household or business economics. There are obvious exceptions. A big tree in the wrong place. The physical layout/orientation of a property which deprives it of access to the sun. A very rainy, cloudy climate. There are reasons why solar wouldn’t work for an individual consumer. For the average buyer of utility electricity, however, one cannot lose going solar, across the globe. And the same back of an envelope math can show that one cannot win as big leasing solar as they could owning solar. Third, unknown to many, the preponderance of commercial properties in California, multi-tenant properties, are unable to adopt solar for regulatory reasons that make no sense and that sooner or later will have to be removed. And, lastly, again California leading the way, as transportation propulsion moves to electric, the math for adopting solar looks all the better especially as batteries get bigger and cheaper. The same technology and economies of scale that makes batteries bigger and cheaper also strengthens the argument for leaving the grid altogether or at a minimum taking less and less from the grid. This is to leave out of the discussion for now the prospects for “community solar,” largely because the writer doesn’t fully understand yet how offering credits to renters (persons without property rights) works.

There should be little doubt that the utilities will eventually succumb to the logic of solar while attempting to retain their centralized generation model by building massive solar plants outside the urban-suburban metropolises and transporting the electrons home. The point to make, however, is that even if the utilities abandon fossil fuels entirely, from a consumer’s perspective it will always pay to put the solar on your property, assuming that the physical conditions are conducive. As long as the utilities have to charge their consumers to transport the electrons from a distant source, even if that source is solar, it pays to put the solar on your property ….. and also own it. The only impediment to accelerated adoption of distributed generation solar everywhere is financing ownership.

This is not to discuss environmental issues at all. This is written while the fourth largest city in the U.S. is being flooded by a stalled hurricane turned tropical storm that is drawing its energy from water in the Gulf of Mexico that is two or three degrees hotter than the historical norm. Why did Harvey strengthen so fast and “unexpectedly”? Houston will be years rebuilding. How does it defend itself from something like Harvey happening again? What will be the costs? And then, What happens when the first major metropolis somewhere on the globe has to be abandoned because of sea level rise? It’s not a question of whether this will happen, only when.

It’s unquestionably true that most current adopters of solar are not doing so to save the planet. They want to save money on their utility bill and the lease sales persons are offering consumers “something for nothing.” Why not? At the same time, although proponents of ownership can show that ownership is a better deal if you’ve got cash to buy, they still can’t offer most property owners loan-to-own because the banks aren’t yet all in. Solar Payoff’s job is to bring the banks to the game, convincing at least one or several that they should look at solar like car loans or home mortgages. That they eventually will is also a certainty, especially when the banks discover that a loan for an EV or PHEV can be packaged with a solar loan. The only question is finding the resources and the linkages to pull the banks in.

The Ask. Solar Payoff is looking for $3 million in three tranches, based on performance with a seven-fold future dollar investor return in seven years. A budget and financial projections are available. What will we do with the money?

Y 1. Recruit credit unions and banks (a process already underway); Proof-Of-Concept trials on four (sets of) California Service Areas; advertise-advertise-advertise in our four Proof-Of-Concept regions; website finishing touches (JobsModule); extension of back-end to other regions/countries (e.g., Brazil); hire accountant, office manager-admin assistant. $0.5 million

Y2. Build out in CA Services Areas; contractor recruitment will start Y1 but by early Y2 all 31 CA Service Area SunCrafters Alliance will be fully populated (3 contractors to a Service Area); three regional managers/overseers, put Barcelona programmers on annual retainer; find corporate space, possibly in Los Angeles. $1.25 million

Y3. Aggressive Expansion. Everywhere in the U.S. that the utilities haven’t killed retail-priced netmetering. If Brazil still makes sense, push that. Southern Europe. Possibly Australia, Southeast Asia. Never China. Unlikely, but keep an eye on Lebanon, parts of North Africa, the Gulf States. Move early Python Pylons code to Python Django. $1.25Million

Solar Payoff will make money in four, depending on circumstances, five ways:

- By charging commissions on the value of SunCrafters Alliance jobs won from Solar Payoff leads

- By charging a modest per use fee for our SAAS BidModule (eventually also JobsModule) to contractor members of the SunCrafters Alliance

- By charging a brokering fee on loan financing that passes through Solar Payoff to clients of contractors in the SunCrafters Alliance

- By charging a brokering fee for core inputs (panels and inverters, possibly racking systems) sourced directly from manufacturers through Solar Payoff

- Conditions inviting, we might make the Contractor Platform available to all contractors anywhere for a modest user fee, whether the contractor is in network or not. We would not consider making our software available on monthly per-user per-company fee which is current industry practice. This would be strictly pay something fair if/when you click “Publish” bid (same deal we’re offering network contractors developing their own leads).

Financial Projections. A 10-year financial projection is available at www.solarpayoff.com/busplanfinancials (u: investor; p: investor). More detail is available on request.

The Lynchpin. With our software operational and the market ripe, what’s missing is the obvious, financing entities. Our initial inquiries in that respect have been very positive. Stay tuned …..